Tech Kiwari - The history of Google, like thousands of other seekers of happiness in the world of high technology, began during the Internet boom in the second half of the 90s. Its founding fathers, Larry Page and Sergey Brin, turned it into one of the most valuable public companies in the world, with a capitalization of over an astronomical $1 trillion at its peak. However, the coronavirus pandemic and the evolving global economic crisis have significantly shaken the optimism of shareholders, hitting the price of Google shares. Perhaps, taking advantage of the low price of Google shares today, it is the perfect time to buy securities of the Internet giant? Or is it worth waiting for the development of the situation?

THE BIRTH OF GOOGLE

There have been many happy moments in the history of Google's rise. Take, for example, the scientific work of Stanford mathematics student Larry Page. In 1996, he was just looking for a suitable topic for writing a dissertation. It seemed to him a very successful direction for studying the mathematical foundations of the then-nascent Internet. It occurred to the gifted student that it would be best to represent links as a graph - a mathematical structure of many interconnected vertices.

Brin's supervisor, renowned mathematician and AI researcher Terry Winograd, recommended that Larry take up this particular topic. Subsequently, the illustrious billionaire called this advice "the best he has ever received." Maybe there wouldn't be Google today without Winograd's insight.

At that time, search decisions were based on criteria such as the frequency of mention of a particular word. Page realized the dead end of this idea and began to investigate how many links led to a particular page. He suggested that the link mass in the SERPs would become a more relevant criterion, which would significantly improve the usefulness of the system.

Page's friend Sergey Brin, whose family moved to the US from Moscow in 1979 when he was 6 years old, soon joined the study.

In March 1996, friends set up the first BackRub search engine, and on September 15, 1997, the most famous Google.com domain on the Web was registered.

Having equipped an office in the garage of a friend, in 1998 Page and Brin registered their first company. It soon received an initial $100,000 investment from Sun Microsystem founder Andy Bechtolsheim.

By the beginning of 1999, Larry again grabbed the bird of happiness by the tail. This time, chance took him away from the worst decision he could ever make. This is a legendary story, how in early 1999 the founders wanted to sell their offspring for $1 million dollars to the Internet service Excite. However, a potential buyer, represented by director George Bell, considered even $ 750 thousand too high a price for "another search algorithm."

Later risk philosopher, statistician and trader Nassim Taleb would cite this story as a textbook example of the role of chance in business.

The idea of business partners turned out to be so successful that by mid-1999 the project had earned a lot of accolades that put Google above the then industry leaders. The company moved to Silicon Valley, where it is based today. Within a few years of the move, Page and Brin's brainchild beat longtime industry leader Yahoo.com and dozens of other smaller competitors. Friends no longer thought about selling Google.

A MONOPOLIST WHICH IS “ASHY” OF ITS STATUS

While still student idealists, Page and Brin were supporters of the purity of the Internet, its non-commercial nature. However, in 1998, friends changed their minds, believing that a little advertising would not hurt anyone. Today, the search advertising market brings Google tens of billions of dollars in profits.

In 2000, Google started monetizing search results directly by selling ads related to search keywords. Since then, the advertising business has been the basis of the corporation's income, steadily exceeding 75% in their structure.

The company has faced accusations of abuse of monopoly status more than once in its history. Indeed, the company's dynamics in the global search engine market has only been growing over the years. For example, in 2020, according to some estimates, it reached 91.54%.

Source: https://www.webfx.com/

Over the past decade, Google has been the subject of investigations for possible abuse numerous times. Only in 2019 can we recall the antitrust investigation in the EU and the US. They concerned the features of the collection of personal data of users and the behavior of the company in the advertising market. There have been dozens of such accusations throughout history. But none of the cases were painful enough to seriously hurt the company and bring down the value of Google's stock. Although sometimes it was necessary to pay fines for billions of dollars.

In 2014, in his book From Zero to One, Peter Thiel, the legendary venture capitalist, startup ideologue, and founder of PayPal, writes that the Google monopoly is a kind of useful monopoly. On the one hand, such companies are a cash generator for investors. Only in a market without competitors can you earn such huge money. On the other hand, Google is an innovative company that makes a socially useful product, which makes the negative impact of the company's monopoly status not so obvious. Thiel also writes that the very status of a monopolist is very ambiguous. Indeed, if we take the global advertising market, then the share of Google is not so large (in 2014 it was 3.4%). There is always an alternative.

Thiel also points out that a real monopolist will never boast of his monopoly, otherwise you can quickly get such proceedings that will ruin you. So Google is a "modest" monopolist that never sticks out its dominance in the market.

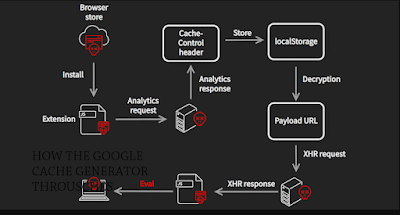

HOW THE GOOGLE CACHE GENERATOR THROUSCHES

The basis of Google's wealth and fame is advertising. When starting a conversation about the prospects for the price of a Google stock, you also need to pay special attention to this topic. Of course, there are also cloud services, the production of mobile phones and even self-driving cars, but these are all pennies in the overall revenue structure.

After 2001, Google's revenue from search and other types of advertising ranged from 75% to 99% of the total. In the chart below, blue is search ad revenue, dark blue is other ad revenue, and gray is revenue from other sources.

In absolute terms, the last decade has been truly golden for Google-Alphabet, because revenues and profits have only grown. 2019 was the most successful year in the history of the company in terms of key financial indicators: Total Revenue (Gross income) grew by 18% and reached almost $162 billion, while net profit grew by 12% and exceeded $34 billion, which is an order of magnitude more. As you can see from the table below, these numbers are an order of magnitude higher than in 2016, when gross revenue was just over $90 billion and net income was $19.4 billion.

Source: investing.com

It is not surprising that the capitalization of Alphabet grew by leaps and bounds until the beginning of 2020. In February 2020, the closing price peaked at $1,526 per Google share, with a capitalization of $1.05 trillion. In the history of the US market, only Apple, Microsoft and Amazon have managed to overcome this bar.

Due to the growth of Google shares from April 2015 to February 2020 (before the collapse in the US stock market due to the coronavirus pandemic), the company's value soared almost three times, which is one of the most impressive results among all technology companies.

Adds optimism to investors and the fact that the global online advertising market shows a steady growth rate. Experts' forecasts are also optimistic, which provides significant support for the value of Google shares today.

Thus, according to the analysis shown in the chart below, the global market can grow from $333 billion in 2019 to $517 billion in 2023. The share of digital advertising among all media (blue line) is growing. Although the growth rate (red line) is steadily declining, one cannot ignore the concept of the base effect.

Alphabet has evolved into a real cash generator in recent years. According to Peter Thiel, the only way to break this order of things is to interfere in the business of competitors. In the aforementioned book From Zero to One, he argues that the most competitive markets (such as air travel) are always the lowest profitable. Competition kills capitalism. Most US airlines are struggling to make ends meet due to extremely fierce competition, despite the gradual growth of the market. Only monopolists enjoy abundance.

Can anyone shake the position of Google, whose annual revenue and profit growth (Google's quarterly earnings dynamics - in the chart below) has consistently exceeded 10% over the past decade?

The company has no serious competitors in the field of search traffic. Also not visible on the horizon is who can take the fight to video hosting YouTube (bought by Google in 2006 for $1.65 billion), and this unit generates nearly 15% of the company's gross revenue.

A small threat may come from the fact that the media advertising market itself is modernizing. Every year, Facebook is gaining momentum with its Instagram. Amazon is also developing traffic monetization. Not to mention the more “small fish”. Thus, the data of modern research show that since 2016, Google's share in the US online advertising market has been declining. The market is becoming more diversified.

In the US market, Google's position is no longer called a monopoly. We are talking about a "duopoly" - most of the market is occupied by 2 companies - Google and Facebook. Below is a table with their shares in the US online advertising market in 2016-2018 with a projection up to 2020.

GOOGLE IN 2020: THE IMPACT OF THE CORONAVIRUS PANDEMIC ON STOCK

Google welcomed 2020 as one of the most technologically advanced companies in the world. In addition to the traditional advertising and media business, it is developing in a number of other promising areas. Corporation divisions have made significant progress in quantum computing, declaring the achievement of legendary quantum superiority - computing power that is capable of solving problems beyond the control of conventional computers. Google is one of the world leaders in the development of artificial intelligence. The biotechnology divisions of the company are working on tasks to extend life and improve human health.

The real “black swan” for the value of Google shares today was the coronavirus pandemic, which brought down financial markets in late February and March 2020. Google shares lost more than $400 in price, falling from an annual high of over $1,500 to $1,056 at the close of the day on March 23 in a couple of weeks. Such a sharp drop in the Google/Alphabet quotes (chart below) has never been known in its history.

However, the sharp collapse is not so surprising in the context of global markets, because at the same time the S&P 500 index lost more than 40%. Not a single security from the index managed to stay above the 50-day moving average.

Numerous dire forecasts for the global economy in 2020 are playing against Google stock quotes today. According to the IMF, OECD and influential economists, global GDP could lose up to 2%, which is even worse than during the 2008-2009 crisis. Naturally, the digital advertising market, which is the main one for the corporation, has also come under the threat of a sharp decline. Most clients are likely to be forced to cut budgets.

SHOULD YOU BUY GOOGLE STOCK?

In favor of buying shares, on the other hand, says the unprecedented measures of the Fed and the US government. To combat the crisis, the US Central Bank cut its key interest rate from 1.5% to zero and announced an unlimited quantitative easing program that could reach $5 trillion. The Trump administration and Congress are taking equally impressive steps to support ordinary Americans and businesses with a $2 trillion program. In conditions of excess liquidity, Google shares look promising, despite the likely loss of part of the revenue.

According to an average estimate of 45 analysts polled by The Wall Street Journal, the value of Google securities should recover to $1,551 by the end of 2020.

At the same time, experts are quite unanimous - 35 out of 45 at the end of March 2020 recommended buying Google shares. However, although the expectations are very optimistic, one must also remember that analysts are quite often wrong. No one knows the future 100%, especially when it comes to stock forecasts.

FUNDAMENTAL ANALYSIS OF GOOGLE STOCK

The company's fundamentals look attractive. The price-to-earnings ratio (or p/e) fell close to a 5-year low to 22.

Google's financial position is strong. The debt load is low - only about $16 billion of total debt in 2019, with annual revenue of $161 billion - a penny. Thanks to revenue growth of an average of 20%, the company has amassed a whopping $115 billion in cash reserves. In recent years, Google has been actively investing in development and buying promising businesses. It is quite possible that in 2020, against the background of the crisis, not a single high-profile deal awaits us.

WHEN IS THE TIME TO BUY GOOGLE STOCK?

The financial position of the Internet giant does not inspire much concern. Low debt, high cash flow liquidity and huge cash reserves create a reliable financial cushion during the crisis. However, when buying Google shares for the long term, it is worth considering the risk of a protracted financial crisis in the world.

Back in early April 2020, most economists were inclined to think that the crisis would have a W-shape. This means that there will be two waves of economic decline, after which a rapid recovery will begin.

By the middle of the month, more and more experts are talking about the risk of an L-shaped crisis - a fall with a protracted recession. In this case, Google stock quotes can get stuck “in the sideways” for a long time.

When is the best time to buy Google stock? There is no obvious answer to this question, since it is unrealistic to give guarantees for financial markets. However, there are methods to help reduce the risks. For example, you can create a shopping plan based on the chart and dynamics of Google shares.

For example, about half of the planned volume to buy in case of maintaining long-term support of about $1,000 per share. However, it is better to wait for another wave of decline, since the current recovery in the value of Google shares is very likely just one of the waves of correction. The likely goal of the current correction is to test the lower limit of the rising channel ($1220-1240), which was broken in mid-March.

About 25% more of the planned volume can be added when more reliable buy signals appear. Before the start of growth, the price often “draws” something like a “double bottom” or an inverted “head and shoulders” pattern (technical chart patterns). After testing the support levels and breaking the formation up, the reliability of purchases will increase significantly. The remaining 25% can be collected already in the phase of obvious growth.

It is also imperative to keep in mind that the $1,000 per share level is not cast in concrete and iron. A possible breakout with the closing of the weekly candle below the support will signal that the crisis has dragged on and it is better to wait with stock purchases. The main task of an investor during any financial crisis is not to lose. If you manage to keep the capital, there will definitely be more opportunities to buy Google stock.

CREATORS OF THE FUTURE: INSTEAD OF WITHDRAWAL

Google has become one of the main technological pioneers of the 21st century, and has made its founders Larry Page and Sergey Brin one of the richest people on the planet. Its numerous services, be it a search engine or the Android operating system, cloud services or office applications, are deeply integrated into the daily life of the majority of the world's population.

Nobody knows the future, however, it must be admitted that the chances of Google innovators to maintain their role as a world technology leader in the third decade of the century look achievable. In such breakthrough areas as quantum computing, artificial intelligence, and even biotechnology, Page and Brin's company is one of the world leaders.

Of course, the main distinguishing feature of billionaire friends is not luck, although she has favored them more than once. They have a long-term vision and have not forgotten what it is like to be dreamers, investing generously in technologies that make the future much closer, and perhaps a little better.

Post a Comment